According to the data shared by Education Data Initiative in 2025, the average cost of tuition at public four-year colleges in the US reached $27,146 per year for students living on campus. As shocking as this may seem, it’s true!

However, having the right savings plan, like a 529, can save you and your child thousands in taxes and loan repayments. So, now is the time to start saving for your child’s higher education.

This blog introduces you to the 529 plan for student savings and compares it with alternatives, such as traditional savings accounts, Coverdell ESA, Roth IRA, and custodial accounts. Stay tuned.

| Short On Time? Here’s A Quick Summary:

529 plan: Tax-free growth and withdrawals for education; some market risk. Savings Account: Safe but low growth, no tax benefits. Coverdell ESA: Tax-free for K-12 and college, but low contribution limits. Traditional IRA: Penalty-free education withdrawals, but taxable. Roth IRA: Penalty-free for education, affects financial aid. Custodial Accounts (UGMA/UTMA): Flexible but taxable; child can control at age 18-21. |

What Is A 529 Plan?

A 529 plan is a tax-advantaged savings account to save for your child’s schooling.

- Sponsored by states or schools.

- Let’s you invest in funds, stocks, or bonds.

- Let your money grow tax-free.

- Withdrawals are tax-free for qualified education expenses.

| Financial expert Chris Meyers, President at Diversified Consumer Planning LLC, shares on their LinkedIn that “529 college savings plans offer a unique combination of features that no other college savings option can match, thanks to their tax benefits, high contribution limits, and versatility”. |

What Are The Types Of 529 Plans?

Prepaid Tuition Plans: Parents can lock in the current tuition rates (at selected colleges and institutes) for their child to attend college in the future. However, this doesn’t cover expenses like room and board and other student needs and is limited to state private schools.

College Savings Plans: It works like an investment account for education expenses. The funds can be used for tuition, books, housing, computers, and more. It is tax advantageous and offers flexibility in choosing different schools.

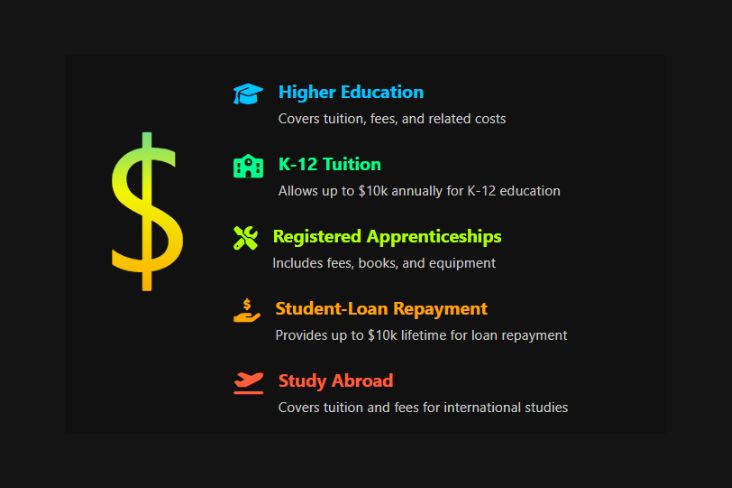

What Is A Qualified Expense And A Non-Qualified Expense For A 529 Plan?

| Covered (Qualified Expenses) | Not Covered (Non-Qualified Expenses | |

|

|

College or vocational tuition | Optional classes not part of the degree |

|

2. |

K–12 tuition (up to $10,000/year) | Private tutoring or test prep courses |

|

3. |

Books, Laptop, internet | Gaming devices, phones |

|

4. |

Student loan repayment (up to $10,000 lifetime) | Credit card debt |

|

5. |

Room and board (within the school’s cost of attendance) | Transportation costs (e.g., airfare, gas, car maintenance) |

What Are The Benefits Of A 529 Plan?

High Contribution Limits: There is no federal annual contribution limit for 529 plans, but states set lifetime contribution limits per beneficiary, generally ranging from $235,000 (e.g., Georgia) to $575,000 (e.g., California).

Different Qualified Uses: With a 529 plan, you can withdraw tax-free money for college expenses, K-12 tuition ($10,000/year), apprenticeships, and student loan repayment ($10,000 lifetime).

Tax-Free Growth: Under IRS rules, contributions to a 529 plan are considered gifts to the beneficiary. In 2025, the annual gift tax exclusion is $18,000 per person per beneficiary (or $36,000 for a married couple giving to one child).

Flexibility: If your child doesn’t need the money, you can switch the 529 account to another family member, like a sibling or even yourself, for education.

Rollover option: The recent legislative change, SECURE 2.0 (in action since 2024), allows you to move up to $35,000 of leftover money from a 529 plan into a Roth IRA for your child, as a tax-free retirement savings.

WHAT’S THE CATCH: ‘Transfers are limited to the annual Roth IRA limit ($7,000) and the 529 account needs to be at least 15 years old to do this.’

What Are The Limitations Of The 529 Plan?

Market Risk: The money in a 529 plan is invested in mixed assets like stocks or bonds, which have the potential for higher returns. However, since the account is market-based, it can fluctuate with market performance and involve market risk.

| Tip: It’s best to strategize with the help of a financial expert to adjust risk and achieve maximum returns. |

Non-Qualified Withdrawal Penalties: If you use the money for non-qualified expenses, you will owe income tax and a 10% additional tax penalty. However, certain exceptions apply, such as if the beneficiary receives a scholarship, attends a U.S. military academy, or passes away.

Financial Aid Impact: Assets held in a 529 plan are considered parental assets on the FAFSA (Free Application for Federal Student Aid). So, it might impact the chances of your child’s eligibility by 5.64% of the account’s value.

| Note: A 529 plan is often the smartest choice for college savings due to its tax benefits, but the best option depends on your financial situation and goals. |

Comparing 529 Plans To Other Educational Savings Options

Option 1: What Is A Traditional Savings Account?

A traditional savings account is a bank account with low, fixed interest rates (around 0.5% to 4% ) and FDIC insurance up to $250,000. It’s flexible but lacks the tax benefits and growth offered by a 529 plan.

529 Plan vs. Savings Accounts

Many parents use savings accounts for child expenses like education, clothes, food, and medical bills. Let’s see how it compares with the 529 plan through this table:

| Feature | 529 Plan | Savings Account |

| Tax Benefits | Tax-free; state deductions possible | Interest taxable annually |

| Growth Potential | Higher, via investments (e.g., stocks, bonds), but with market risk. | Low (~1-4% in 2025), often below college cost inflation. |

| Usage Restrictions | Education-focused | Any purpose.

|

| Safety | Not FDIC-insured; subject to market fluctuations. | FDIC-insured up to $250,000. |

| FAFSA Impact | Parental assets, up to 5.64% | Parental asset (5.64%) |

Saving accounts are not one of the best options for college savings due to low interest rates and the impact on the FAFSA ( Free Application for Federal Student Aid).

Option 2: What Is A Coverdell ESA?

Coverdell is a tax-advantaged account for K-12 and college expenses, with flexible investment options. The account offers flexible, self-directed investment options like stocks, bonds, ETFs, and REITs. The contributions are limited to $2,000 per year per beneficiary; it can only be used by a beneficiary up to the age of 30.

529 Plan vs. Coverdell ESA

| Aspect | 529 Plan | Coverdell ESA |

| Contribution Limits | Up to $350,000+ lifetime; no annual limit. | $2,000/year per beneficiary; stops at age 18. |

| Income Restrictions | None. | $110,000, and for joint filers, it phases out at $220,000 |

| Age Restrictions | None; funds can be used anytime. | Funds must be used by age 30 (except special needs cases). |

| Investment Options | Limited to state plan options (e.g., mutual funds, ETFs). | Self-directed; includes stocks, bonds, ETFs, REITs. |

| Eligible Expenses | College expenses: K-12 tuition, student loans | College and K-12 expenses |

| Tax Benefits | Tax-free growth; state deductions | Tax-free growth; no state deductions. |

| Financial Aid Impact | Parental asset, up to 5.64% | Same as a 529 plan. |

Can You Have Both A Coverdell ESA And A 529 Plan?

Yes! Use a Coverdell for K-12 and a 529 for bigger college savings.

Note: To create the safest and most beneficial strategy, it is best to seek guidance from a professional on how to save for college education.

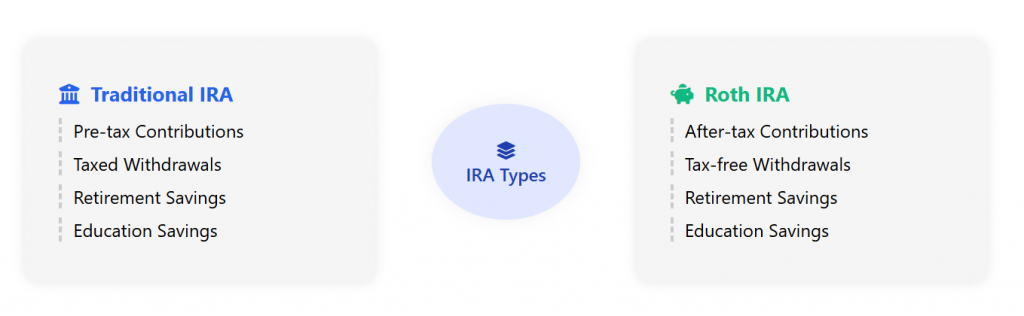

Option 3: IRA Accounts For Education Savings

IRA accounts can be used for education savings. Traditional and Roth IRAs allow penalty-free withdrawals for qualified higher education expenses, making them flexible options for college savings. Let’s read about both Traditional IRA and Roth IRA and their comparison with 529 below.

A) What Is A Traditional IRA?

A Traditional IRA is for retirement, but allows penalty-free withdrawals for college expenses. Contributions are pre-tax, but withdrawals are taxed.

529 Plan vs. Traditional IRA

| Feature | 529 Plan | Traditional IRA |

| Contribution Limits | Up to $350,000-$575,000 lifetime, no annual limit | $7,000 per year (or $8,000 if 50+) |

| Tax treatment of contributions | Contributions are after-tax (no tax deduction) | Contributions are pre-tax, and deduction limits apply |

| Taxation of Withdrawals | Tax-free for education | Taxed as income |

| Flexibility | Allows beneficiary changes | Only for owners’ use |

| Impact on Retirement Savings | Education focused | Reduces Retirement savings |

Here is a 529 vs traditional IRA comparison graph from Google Trends. It shows that interest in the 529 Plan usually increases during the college admission opening each year, which is around August and May.

B) What Is A Roth IRA?

A Roth IRA is for retirement, but it also works for college. Contributions are after-tax and always tax and penalty-free. Earnings are penalty-free for qualified education expenses but taxable unless the account is 5+ years old and you’re 59½.

Also, as discussed earlier, the SECURE 2.0 Act allows the transfer of up to $35,000 from a 529 plan to a Roth IRA for the beneficiary tax and penalty-free. The transaction is applicable if the money is not used for studies, tax, or penalty-free.

What Are The Main Requirements For 529 To Roth IRA Conversions?

|

529 Plan vs. Roth IRA

| Feature | 529 Plan | Roth IRA |

| Purpose | Education savings. | Retirement; usable for college. |

| Contribution Limits | $235,000-$575,000 lifetime. | $7,000/year (2025); $8,000 if 50+ |

| Tax Benefits | Tax-free for education | Contributions tax-free; earnings taxable if under 59½. |

| Withdrawal Rules for Education | Tax-free for education | Contributions and earnings are penalty-free for education |

| Financial Aid Impact | Parental asset, up to 5.64% counted. | Withdrawals count as income, which can reduce aid more than 529 assets. |

Option 4: What Are The Custodial Accounts (UGMA/UTMA)?

A custodial account is established under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA). Custodial accounts hold assets (stocks, bonds, cash) for a child until they’re 18-21. Parents lose control at that age, and funds can be used for anything.

529 plan vs custodial accounts is a hot discussion topic on Reddit. Here is a glimpse of what parents are discussing:

529 Plan vs. Custodial Accounts (UGMA/UTMA)

| Feature | 529 Plan | Custodial Account (UGMA/UTMA) |

| Tax Benefits | Tax-free for education | Child’s earnings are taxable

(Kiddie tax) above earnings of $1350. |

| Control | Parent retains control | The child gains control at age 18-21. |

| Usage | Education-focused; penalties for non-educational use. | Any purpose |

| Financial Aid Impact | Parental asset, up to 5.64% counted. | Child’s asset up to 20% |

In the financial expert Chris Meyers’ words, “A custodial account is considered a child’s asset at financial aid time, which means it will count more heavily,” making it less favorable for college savings than 529 plans, which offer tax benefits and parental control.

Key College Savings Strategies To Consider:

- 529 + Roth IRA: Use a 529 for primary education savings and a Roth IRA as a backup for flexibility or retirement.

- 529 + Coverdell ESA: Cover K-12 with a Coverdell and college with a 529.

- Custodial Account as Supplement: Prioritize a 529 for tax benefits; use a custodial account for other needs.

Note: The above-mentioned strategies may differ according to your personal goals. Therefore, consult a financial advisor to pick the best plan for your family.

Takeaway: A 529 plan is the smartest way for most families to save for college due to its tax benefits and flexibility. Alternatives like Coverdell ESA and Roth IRA have their place in certain situations, while custodial accounts and traditional savings offer flexibility at the cost of tax savings. You can mix and match strategies to best fit your needs by understanding the differences. Contact Diversified Consumer Planning LLC for a custom plan. Book a consultation today!

FAQ:

Q1: Can Foreign Students Benefit From A U.S. 529 Plan?

Ans: Yes, if they attend eligible U.S. or certain international schools.

Q2: What If My Child Doesn’t Go To College?

Ans: You can change the beneficiary to another family member, roll over up to $35,000 to a Roth IRA, or withdraw funds (subject to taxes and penalties if not used for education).

Q3: Can Grandparents Contribute To A 529 Plan?

Ans: Yes, anyone can contribute, and grandparents can open their own 529 plans, which may not count toward FAFSA until funds are withdrawn.

Q4: Are Travel Costs Covered In A 529 Plan?

Ans: Generally, no, unless directly required for education (e.g., study abroad program fees), but not personal travel expenses like passports or airfare

Q5: Can I Roll A 529 Into A Roth IRA?

Ans: Yes, under the SECURE 2.0 Act, up to $35,000 can be rolled from a 529 plan to a Roth IRA. However, the 529 plan must have been held for 15+ years, and only contributions older than 5 years are eligible.

Q6: How Does A 529 Affect Financial-Aid Eligibility?

Ans: It’s a parental asset, reducing aid by up to 5.64% of its value.

Q7: Is The Cost Of Room And Board Covered In A 529 Plan?

Ans: Yes, room and board costs are covered by a 529 plan, as long as they fall within the school’s cost of attendance guidelines, including both on-campus and off-campus housing.